Quarterly Report For The Financial Period Ended 30 June 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

Condensed Consolidated Profit or Loss and Other Comprehensive Income

For the Twelve Months Period Ended 31 March 2018

Condensed Consolidated Statement of Financial Position As at 31 March 2018

Performance Review

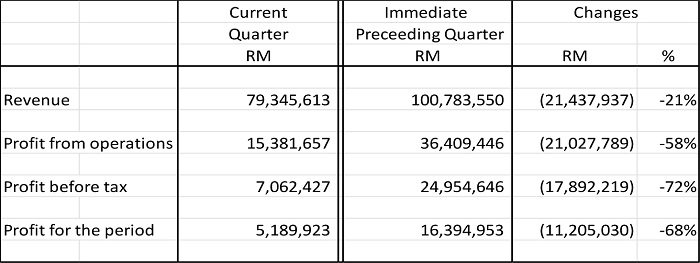

The Group's cumulative turnover for the current financial period ended 31 March 2018 is RM79,345,613 (year 2017-RM67,381,841) and profit before taxation is reported at RM 7,062,427 (year 2017RM7,164,009). The revenue as well as profit before taxation for the current quarter is fairly consistent compared to previous year's corresponding quarter. The Group's performance for this year is mainly derived from profit recognition from sales of inventories in Taman Samudera, progressive profit recognition of Kiara 163 , Sfera Residensi and Taman Sejati II projects.

On a quarter to quarter basis, the current quarter profit before taxation of RM 7,062,427 is lower than previous quarter of RM24,954,646. This is due to the Group registered a softer take up rate for both projects in Kuala Lumpur, namely Sfera Residensi and Kiara 163 in the currect quarter of the year. As a results, the Group recognised a lower profit for the first quarter of the financial year.

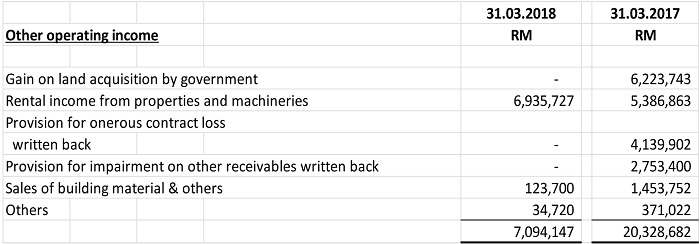

An analysis of other operating income for the current financial period are as follows:

Commentary On Prospects

The local and global economic climate remains challenging. Taking into consideration of the overall reduced contributions from existing projects, the Board look forward for an improvement in the current economic climate and a relaxation in the banking guideline over the subsequent quarters for a reversal of its performance.

The Board is cautiously optimistic of our Kiara 163 mixed development project held under D'Kiara Place Sdn Bhd ("DKP"), a wholly owned subsidiary company of YNH Property Bhd. DKP is the registered and beneficial owner of the 6 acres freehold development property located in Mont' Kiara, Kuala Lumpur, besides McDonald outlet at Plaza Mont' Kiara and opposite One Mont' Kiara. The proposed commercial development comprises:

- 1 block of 46 storey of service apartment and 1 block of hotel suites of 44 storey (718 units) with facilities and multi-storey car park,

- 1 Small Office Versatile Office ("SOVO") Tower,

- 1 shopping mall and basement car park.

The Kiara 163 project has a total GDV of approximately RM1.0 billion with 60% of the GDV comprising of service apartments which are planned to be sold fully furnished and also managed by a reputable manager, with a similar concept like Fraser Place KL. The retail shopping mall will also be one of the main attraction of the development where residents/ tenants have seamless life, work and play lifestyle. Main building work for Kiara 163 has already commenced and is expected to contribute to the Group for the next two financial year.

Another project which is currently undertaken by the Company is Sfera Residensi, which is located at Puchong South, Selangor. The project will have a Gross Development Value of approximately RM426 million, and is expected to complete during the financial year 2018.

Another prestigious project planned for the future by YNH group is the Menara YNH development, located on one of the most exclusive addresses in Kuala Lumpur city centre, in the Golden Triangle area where most prestigious 5 star hotels and upmarket office spaces are found. The commercial development sits on a 130,826 sq ft (approximately 3 acres) of land with a wide frontage of 320 feet along Jalan Sultan Ismail. The location of Menara YNH also offers easy accessibility and close proximity to efficient public transport facilities such as the Putra Light Rail Transport and the K.L Monorail station. It is also located within walking distance to all major hotels and shopping centres. This Menara YNH has a GDV of approximately RM2.1 billion. Approved development order had already been obtained for this development, comprising office tower and shopping mall.

The Group has intention to keep 50% of the Menara YNH referred above as investment property and it will be used as the Group's future corporate headquarter

The Group has also entered into a series of joint venture projects for the development of a few pieces of land strategically located near Mont' Kiara, Hartamas, Kuala Lumpur city centre, Ipoh city and Seri Manjung town. These developments are at planning stage and have an estimated gross development value of RM1.8 billion and are expected to contribute to the Group's earnings for the next 15 to 20 years.

The Group had successfully completed the construction of AEON Mall Seri Manjung in year 2012 and Pantai Specialist Centre at Seri Manjung in November 2013. The presence of AEON Mall Seri Manjung Shopping Centre and Pantai Specialist Centre will further enhance the value of the balance 700 acres of undeveloped landbanks in the Manjung Point Township.

The Company had also in the 4th quarter of 2008 acquired 95 acres of strategic development land bank in Genting Highlands. The Genting land bank is located strategically next to the Genting Highland Resort and was acquired for RM16.05 million. The advantage of this land bank is that the purchase consideration is very low and it comes with infrastructure. The land has already been converted to building title. The proximity to the existing Genting Highland Resort is an advantage as the proposed development will complement the existing infrastructure. Other plus point for this development is that it is located in a cool environment and yet is 45 minutes from the KL city centre as the existing highway is already completed from the KL city centre to the existing resort.

The proposed development for this 95 acres land bank comprises commercial, bungalows, condominium, retail and etc. for both local and foreign investors. The estimated gross development value for this future development is RM1.96 billion and expected to contribute to the Group's earnings in the next 20 years.