Corporate Information

Board of Directors

Dato' Dr. Yu Kuan Chon

62 years of age

Malaysian, Male

Dato' Dr. Yu Kuan Chon was appointed to the Board of the Company on 3 September 2003, and became Chairman on 20 February 2004. After obtaining his medical degree in 1988, he began his career as a houseman in Klang, followed by a role as a medical officer a year later. He subsequently served as a medical officer in hospitals in Ipoh and Taiping, Perak. In 1995, he left government service to assist in the family business.

Currently, he is a Non-Independent Non-Executive Director at Rapid Synergy Berhad, a public company listed on the Main Market of Bursa Malaysia Securities Berhad.

He is the brother of Dato' Yu Kuan Huat, DPMP, PMP, AMP, PPT, and he is a major shareholder of the Company.

He has no conflict of interest or potential conflict of interest with the Company or its subsidiaries. He has not been convicted of any offences within the past five (5) years other than traffic offences, if any, and has not been imposed any public sanction or penalty by the relevant regulatory bodies during the financial year ended 30 June 2024.

Dato' Yu Kuan Huat

66 years of age

Malaysian, Male

Member, Remuneration Committee

Dato' Yu Kuan Huat was appointed to the Board of the Company on 3 September 2003, and subsequently assumed the role of Managing Director on 8 October 2003. Prior to joining the Board, he served as the Managing and Founder Director of Kar Sin Bhd, now a wholly-owned subsidiary of the Company. With over 30 years of experience, his expertise covers a broad range of industries, including property development, construction, money lending, and aquaculture.

He serves as the Alternate Director to Dato' Dr. Yu Kuan Chon, DIMP, PPT, MBBS, at Rapid Synergy Berhad, a public company listed on the Main Market of Bursa Malaysia Securities Berhad.

He is a substantial shareholder of the Company and he is the brother of Dato' Dr. Yu Kuan Chon, DIMP, PPT, MBBS.

He has no conflict of interest or potential conflict of interest with the Company or its subsidiaries. He has not been convicted of any offences within the past five (5) years other than traffic offences, if any, and has not been imposed any public sanction or penalty by the relevant regulatory bodies during the financial year ended 30 June 2024.

Khong Kam Hou

Malaysian, Male

Chairman, Audit Committee

Member, Nominating Committee

Member, Remuneration Committee

Mr. Khong Kam Hou was appointed to the Board of the Company as a Senior Independent Non-Executive Director on 31 March 2023. On the same day, he was also appointed as a member of the respective Board Committees. He was later redesignated as Chairman of the Audit Committee on 1 March 2024.

He graduated from the University of Malaya with a Bachelor's degree in Economics in 1974 and joined the Department of Inland Revenue, Ministry of Finance, as a tax cadet officer in early 1975. Over the course of his career from 1975 to 1991, he served in several key units within the Inland Revenue Department, including tax assessment, corporate tax, and tax investigation. In 1992, he left his role as a senior tax officer and practiced as a licensed tax consultant from 1992 until 2019.

He has no other directorship in public companies and listed issuers. He has no family relationship with any director and/or major shareholder of the Company.

He has not been convicted of any offences within the past five (5) years other than traffic offences, if any, and has not been imposed any public sanction or penalty by the relevant regulatory bodies during the financial year ended 30 June 2024.

He has no conflict of interest or potential conflict of interest with the Company or its subsidiaries.

Ching Lee Fong

Malaysian, Male

Member, Audit Committee

Chairman, Nominating Committee

Chairman, Remuneration Committee

Mr. Ching Lee Fong was appointed to the Board of the Company as a Independent Non-Executive Director on 31 March 2023. On the same day, he was also appointed as a member of the respective Board Committees. He was later redesignated as Chairman of the Nomination Committee and Remuneration Committee on 1 March 2024.

He graduated with a Bachelor of Engineering (Electrical & Electronics) from University Technologi Malaysia. He is currently serving as a Senior Engineer at Intel Microelectronics Sdn Bhd and brings over 23 years of experience in the electrical and electronics engineering industry.

He has no other directorship in public companies and listed issuers. He has no family relationship with any director and/or major shareholder of the Company.

He has not been convicted of any offences within the past five (5) years other than traffic offences, if any, and has not been imposed any public sanction or penalty by the relevant regulatory bodies during the financial year ended 30 June 2024.

He has no conflict of interest or potential conflict of interest with the Company or its subsidiaries.

Lee Zhi Yan

Malaysian, Female

Member, Audit Committee

Member, Nomination Committee

Member, Remuneration Committee

Ms. Lee Zhi Yan was appointed to the Board of the Company as Independent Non-Executive Director on 1 March 2024. On the same day, she was also appointed as a member of the respective Board Committees.

Ms. Lee Zhi Yan graduated with a Bachelor of Commerce from Monash University, Australia. She also holds several professional qualifications, including membership in the Malaysian Institute of Accountants (MIA), the Malaysian Institute of Certified Public Accountants (MICPA), and Chartered Accountants Australia and New Zealand (CAANZ).

She began her career as an Accounts Officer at 7-Eleven Australia and later managed vendor details and payments at Kalari HSE Australia. In 2018, she joined PricewaterhouseCoopers PLT as an Assurance Senior Associate, contributing to audits, risk assessments, and mentoring junior staff.

In 2021, she became Assistant Planning & Reporting Manager at Dutch Lady Milk Industries Berhad, focusing on financial planning and process improvements. Currently, as General & Sales Accounting Manager at Goodyear Malaysia Berhad, she oversees financial reporting, compliance, and accounting activities, while serving as a key business partner.

She has no other directorship in public companies and listed issuers. She has no family relationship with any director and/or major shareholder of the Company.

She has not been convicted of any offences within the past five (5) years other than traffic offences, if any, and has not been imposed any public sanction or penalty by the relevant regulatory bodies during the financial year ended 30 June 2024.

She has no conflict of interest or potential conflict of interest with the Company or its subsidiaries.

Chairman's Statement

Extracted from Annual Report 2024

Dear Valued Shareholders,

On behalf of the Board of Directors of YNH Property Bhd ("YNHP" or "the Company"), it is my honour to present to you the Annual Report and Audited Consolidated Financial Statements of the company and its subsidiaries ("YNHP Group" or "the Group") for the financial year ended 30 June 2024 ("FYE2024").

In FYE2024, YNHP continued to solidify its foundation in township development, especially in the Manjung District, Perak, which remained a key source of stable revenue. Our project, The Solasta Dutamas, also contributed significantly to the Group's earnings.

Solasta DutamasLocated within the Mont Kiara neighborhood, Solasta Dutamas is making steady progress, with construction advancing smoothly as of 30 September 2024. The development, featuring 1,159 serviced apartment units, has generated strong interest from young professionals and urban dwellers seeking convenient city access. We are optimistic about its prospects and look forward to the project’s contribution to our revenue in the coming years.

Genting Highlands DevelopmentThe Company has in the final quarter of 2008 acquired 95 acres of strategic development land bank in Genting Highlands. The Genting land is located strategically next to the Genting Highland Resort and was acquired for RM16.05 million. The land has already been converted to building title. The proximity to the existing Genting Highland Resort is an advantage as the proposed development will complement the existing infrastructure. Other plus point for this development is that it is located in a cool environment and yet only 45 minutes’ drive from the Kuala Lumpur City Centre.

The proposed development for this 95-acre land includes commercial units, bungalows, condominium, retail units which will be targeted at both local and foreign investors. The estimated gross development value for this future development is RM1.96 billion and it is expected to contribute to the Group’s earnings in the next 20 years.

The 1st phase of the proposed development is a 35-storey serviced apartment building consisting of 908 units. The proposed phase 1 will have an estimated GDV of about RM700 million.

Development Projects in PerakManjung Point Township continues to be a stable source of revenue for the Group. The Group targets to generate RM100 million revenue every year with both residential and commercial project launches in the coming years utilizing a portion of the undeveloped land bank in the Manjung Point Township.

The remaining 700 acres of undeveloped land bank in Seri Manjung is expected to contribute to the Group’s revenue for another 50 years to come.

Corporate DevelopmentThe Board is pleased to inform that the conditions precedent of the Sales and Purchase Agreement for 163 Retail Park have been fully met, making the agreement unconditional as of 23rd September 2024. This milestone not only affirms the value and appeal of our development but also demonstrates the market's recognition of its prime location and quality. The successful completion of this agreement reinforces our position as a developer of highvalue properties and strengthens the company's financial outlook.

AppreciationI sincerely thank our management team and employees for their unwavering dedication and resilience, which has been instrumental in navigating this challenging year. Our deepest gratitude goes to our shareholders, customers, bankers, and business partners for their continued support and trust.

Together, we remain committed to driving the Group forward, pursuing sustainable growth, and delivering longterm value for our stakeholders.

DATO' DR. YU KUAN CHON,

Chairman, Executive Director

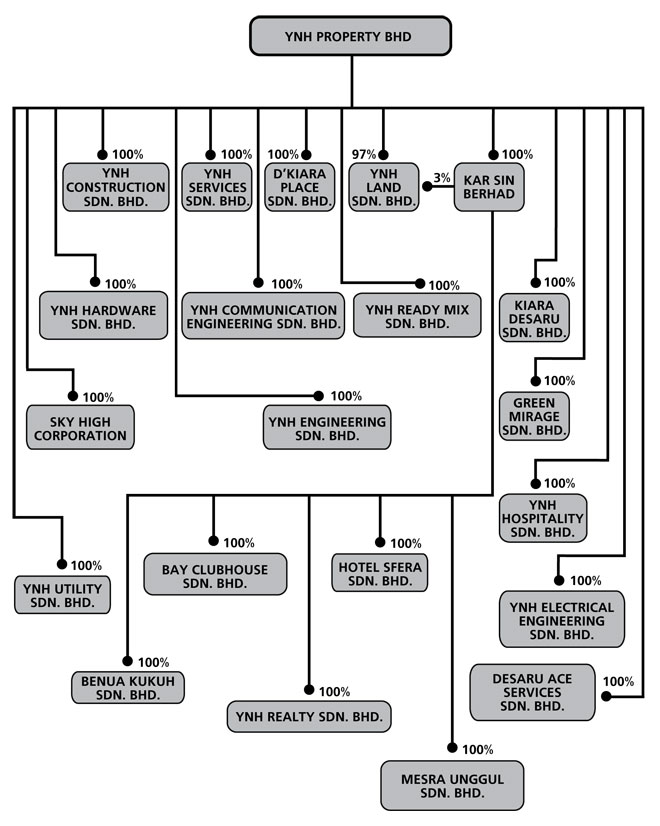

Corporate Stucture

Extracted from Annual Report 2024